31+ Home loan tax saving calculator

Want to know more about the income tax. Here is a look at how to optimise your tax saving using your home loan.

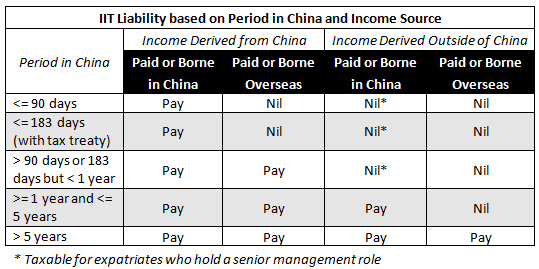

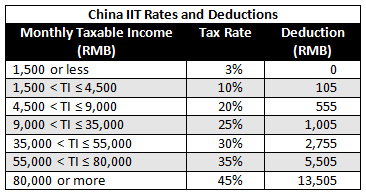

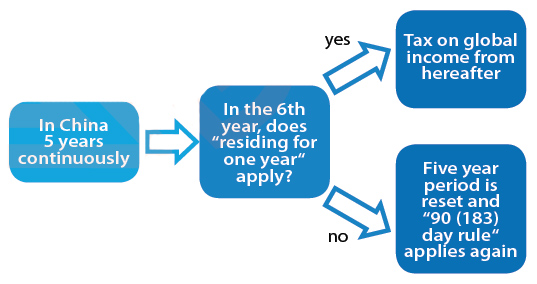

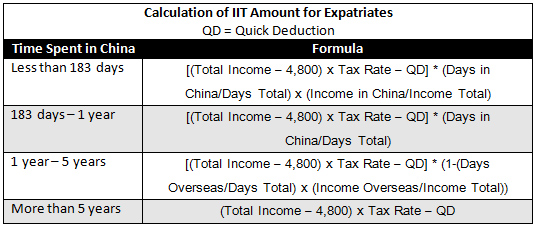

China Expat Tax Filing And Declarations For 2012 Income China Briefing News

If you have missed the deadline of filing income tax return ITR for FY 2021-22 ie July 31 2022 then an individual has an option to file the belated ITR.

. Housing loan interest deduction tax rebate on home loan check tax exemption under section 24 80EE 80C FY 2021-22. What does the Output Page of this EMI Calculator show. The main tax reliefs are listed under Section 80C and Section 24B.

People typically move homes or refinance about every 5 to 7 years. 15 lakh on the interest repayment of home loans taken for affordable houses with stamp value of up to Rs. The output page displays the monthly EMI amount on top.

Example Required Income Levels at Various Home Loan Amounts. Union Finance Minister Nirmala Sitharaman in the budget speech proposed to extend the deadline for availing additional deductions on interest payment on home loans to 31 March. Here is a look at the latest home loan interest rates charged by SBI.

You can use an income tax calculator online to quickly understand your tax liabilityThe income tax calculator is a simple tool that gets updated with the latest rules and regulations and shows you your accurate income tax liability for the yearTo understand how much income tax you need to pay for the financial year ending on 31 st March 2022 use our. First time home buyer. Income tax deduction can be claimed on home loan interest.

Section 80C allows for a deduction of Rs15 lakh towards principal repayment and Section 24B allows for a deduction of Rs2 lakh on the basis of interest repayment. City Median Home Value Median Annual Property Tax Payment Average Effective Property Tax Rate. Effective June 15 2022 the banks EBLR is 755CRP as per the SBI website.

However an individual is required to pay a late filing fee if heshe is filing belated ITR. Section 80EEA provides an additional deduction of Rs. While both loan types have similar interest rate profiles the 15-year loan typically offers a slightly lower rate to the 30-year loan.

The interest rate is the LOWER of the following. Quickly find a home loan to suit your needs whether youre looking to invest refinance or buy a home. 150000 in a financial year from your taxable income through investments in various.

Income Tax Saving on Home Loan for FY 2020-21 AY 2021-22. Business Loan EMI Calculator. Compare top-rated home loans starting at 304 comparison rate 307 from over 120 lenders.

From the loan type select box you can choose between HELOCs and home equity loans of a 5 10 15 20 or 30 year duration. Taking a home loan can help you save tax as per the provisions of the Income Tax Act 1961. Car Loan - With interest rates as low as 700 pa.

Income-contingent loans known as Plan 1 loans by the Student Loans Company SLC. Build home equity much faster. Read our guide to representative APRs for all current best buy personal loans on Money Saving Expert Read our guide to representative APRs for all current best buy personal loans on Money Saving Expert.

Who has them. Income Tax benefits on Home loan. These home loan tax exemptions can only be claimed to purchase houses with a stamped value of up to Rs.

The loan must have been sanctioned between 1 April 2019 to 31 March 2022 extended from 31 March 2021 On the date of loan sanction the individual does not own any other house ie. Compare home loan rates from over 120 lenders. Natwest RBS Ulster Bank.

Amount of loan. You can also claim house loan tax deductions for registration fees and stamp duty charges under Section 80C. 275 How the interest rate is set.

Compare Best Car Loan Interest Rates in. Homeowners can claim the benefits on loans availed till 31st March 2022. The last date of filing belated ITR is December.

English Welsh and Northern Irish students who started higher education between 1998 and 2011 and Northern Irish students starting after 2012. Even more so after the announcements made during the latest financial budget. Home Loan EMI Calculator.

You can take the loan for 90 to 100 of the on-road price of the car. The aggregate deduction allowed under this section cannot exceed Rs 1 lakh and is allowed for FY 2013-14 and FY 2014-15. You can also calculate the EMI on home loan manually using the below formula.

Explore personal finance topics including credit cards investments identity. For the sake of this calculation a 30-year fixed-rate home loan is presumed with a rate at 5 APR. Stamp Duty should actually be paid.

The following table shows the required income needed to have a 28 DTI front end ratio on a home purchase with 20 down for various home values. This is an added cost on top of UFMIP. And a repayment tenure of up to 8 years you can find the most suitable car loan for your needs at BankBazaar.

Cryptocurrency Tax Calculator. The loan must be sanctioned between 1 April 2013 and 31 March 2014. If your loan is 360000 your annual MIP payment costs 3060 a year which is 255 per month.

Find out how much. This home loan calculator gives the following information on the output page. SBI External benchmark linked lending rate SBI has raised the minimum interest rate on home loans.

80 EEA on new housing loans sanctioned in FY23 as the special benefits announced in Budget 2019 expired on March 31 2022. 57488 Total amount you repay. A break-up of the total amount payable is shown below which provides the details of the loan amount the interest due and the total amount payable.

Total charge for credit. Meanwhile annual MIP is usually 085 of your loan amount. Tax-Saving Mutual Funds ELSS Section 80C of the Income Tax Act 1961 allows you to avail deductions of up to Rs.

As per the Income Tax Act of 1961 you can get annual home loan tax benefit via both the interest and principal components of the loan. For example if your loan is 360000 your upfront MIP cost will be 6300. Why annual interest outgo of your home loan is most critical You can save income tax on the home loan principal repayment amount up to Rs 15 lakh each year under section 80C of.

Know more how you can save tax with ICICIdirect through Tax-Saving Mutual Funds National Pension Schemes Life Insurance and Health Insurance. In the Union Budget 2021 the Government extended the deadline to. Where P Principal amount N Loan tenor in months and R Monthly interest rate If the annual rate of interest is 6 the value of R will be 612 x 100 0005.

Rising Home Equity Through the middle of 2018 homeowners saw an average equity increase of 123 for a total increase of 9809 billion. Home Loan EMI Calculator. Formula for EMI Calculation is P x R x 1RN 1RN-1.

If a person stretches their loan payments out to 30-years they build limited equity in.

How To Save Money Fast 3 Tricks Above 1000 Hr

Timeline Photos Art Architecture Design Facebook Kerala House Design Modern House Design Home Design Floor Plans

![]()

How To Calculate Salary Structure For Freshers Career Guidance

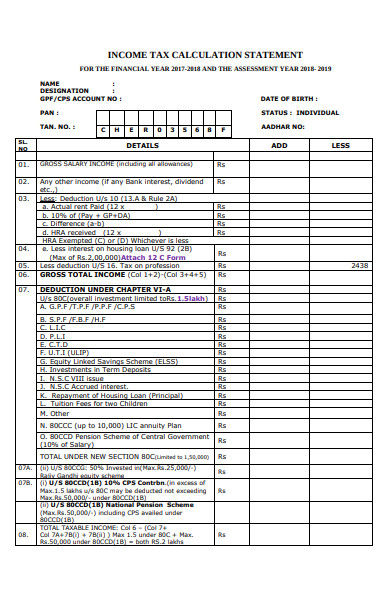

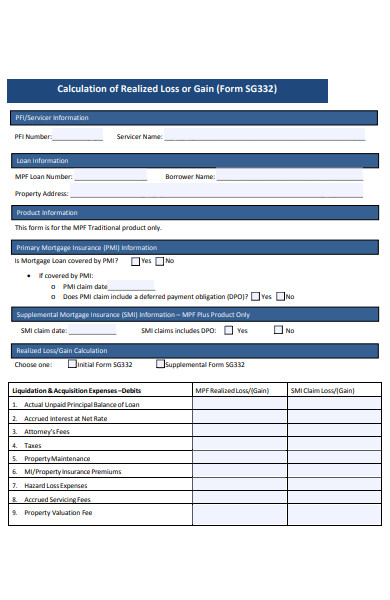

Free 31 Calculation Forms In Pdf Ms Word

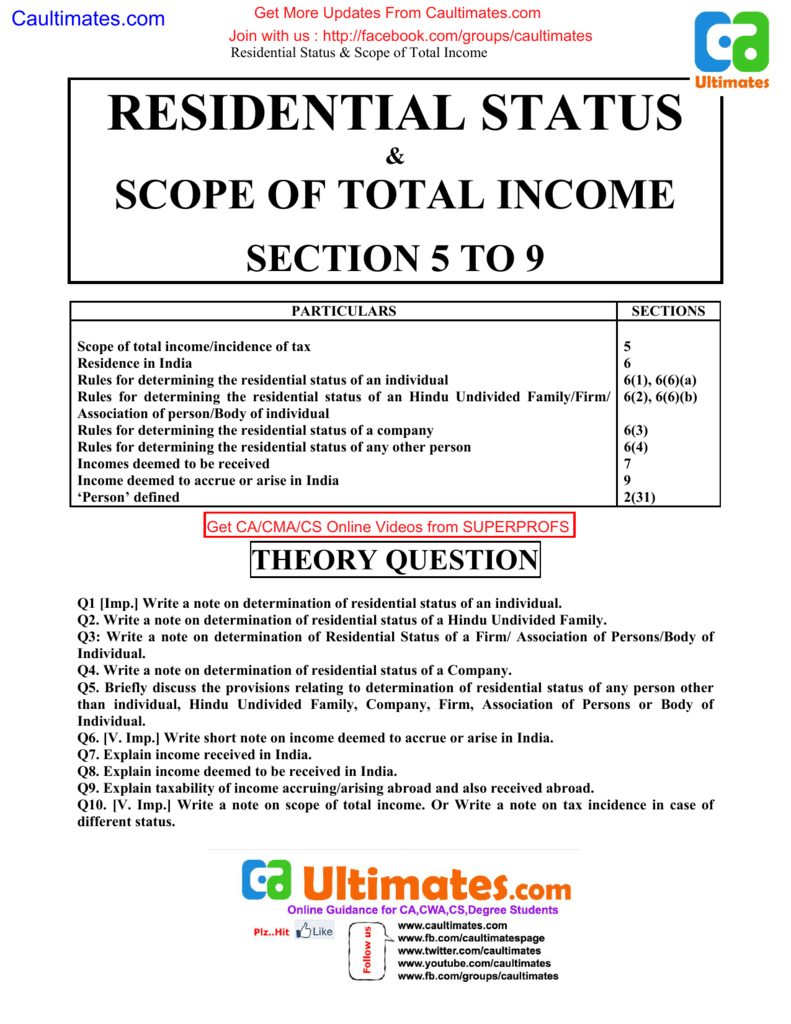

Residential Status

China Expat Tax Filing And Declarations For 2012 Income China Briefing News

China Expat Tax Filing And Declarations For 2012 Income China Briefing News

4081 N Chipmunk Trl Lincoln Mi 48742 Mls 201818434 Zillow

China Expat Tax Filing And Declarations For 2012 Income China Briefing News

2

![]()

How To Save Money Fast 3 Tricks Above 1000 Hr

The Financial Budget Manual By Aginfo Issuu

Free 31 Calculation Forms In Pdf Ms Word

China Expat Tax Filing And Declarations For 2012 Income China Briefing News

O Rb8uqdjtsksm

Free 31 Calculation Forms In Pdf Ms Word

How To Save Money Fast 3 Tricks Above 1000 Hr